In today’s fast-paced world, financial flexibility is crucial. Unexpected expenses can arise at any moment, requiring immediate attention and funds. Cash-Express.ph has emerged as a reliable solution for Filipinos seeking quick and easy access to loans. This article delves into the details of Cash-Express.ph, exploring its services, benefits, and how it has become a trusted financial partner for many in the Philippines.

What is Cash-Express Philippines?

Cash-Express Philippines(Cash Express PH), operated by Cash Express Financing Co. Inc is an online lending platform in the Philippines that provides quick and convenient cash loans to individuals. It allows users to apply for loans online without the need to visit a physical branch, making it a highly accessible service.

Cash Express PH aims to provide a quick and hassle-free solution for individuals needing immediate financial assistance. It is particularly useful for those who may not have access to traditional banking services or need funds urgently.

Summary Of Cash-Express Philippines

| ✅ Cash Express PH official website | www.cash-express.ph |

| ✅ Loan Amount | Ranging from 1,000 PHP to 30,000 PHP |

| ✅ Age Eligibility | 21-70 years old |

| ✅ Loan Term | 7, 14, 21, 31 days period |

| ✅ Interest Rate | Interest rate for the first 14-day: Only 1% interest per day for our unsecured loan product. Interest ratefor repeat one:1.5% – 3,98 per day |

| ✅ Special offer | 0% Interest rate for the first 7-day |

| ✅ Requirements | Filipinos that are currently living in the Philippines. Passport, National ID, Driver’s licence, SSS, UMID, Postal ID, PRC ID |

| ✅ Loan decision | 5 to 15 minutes |

| ✅ Occupation | Currently employed or with a stable source of income |

| ✅ Repayment Options | Dragon Pay |

| ✅ The Pros | Fast, Easy & Convenient, Legitimate, Minimal Complaints |

| ✅ The Cons | Limited initial loan amount |

| ✅ Effectiveness Rating | Good |

| ✅ Bad Credit Acceptance | Not Allowed |

| ✅ Contact Number | (632) 7902 73 90 |

| ✅ SEC Registration Number | CS201951088 |

| ✅ SEC Certificate of Authority No | 2918 |

Is Cash-Express Legit?

Cash Express Philippines is a legitimate online lending platform. Here are several points that support its legitimacy:

- SEC Registration:

- Cash Express Philippines is operated by Cash Express Financing Co. Inc., which is registered with the Securities and Exchange Commission (SEC) in the Philippines(Registration No.CS201951088, Certificate of Authority No.2918). This registration ensures that the company complies with local laws and regulations governing lending practices.

- Accreditation and Compliance:

- The platform is accredited by the National Privacy Commission, highlighting its commitment to protecting users’ personal data and adhering to data privacy laws

- Transparency:

- Cash Express emphasizes transparency in its operations by not charging extra fees and providing clear information about interest rates and loan terms. This transparency is crucial for maintaining trust with borrowers.

- Compliance with Lending Regulations:

- As a regulated entity, Cash Express adheres to the lending regulations set by the Bangko Sentral ng Pilipinas (BSP) and other relevant authorities, ensuring fair and lawful lending practices

Pros and Cons of Cash Express PH

Pros

- Convenient Online Application:

- Description: The entire loan application process is conducted online, making it accessible from anywhere without the need for physical visits to a bank.

- Benefit: This saves time and effort, providing a hassle-free experience for users.

- Quick Approval and Disbursement:

- Description: Loan applications can be approved within 15 minutes, and funds are transferred directly to the applicant’s bank account.

- Benefit: Ideal for urgent financial needs, ensuring that users receive the money quickly.

- User-Friendly Interface:

- Description: The platform features an intuitive interface that is easy to navigate.

- Benefit: Simplifies the loan application process, even for those who are not tech-savvy.

- No Extra Fees:

- Description: Cash Express emphasizes transparency by not charging hidden fees.

- Benefit: Users can trust that they are only paying the agreed-upon interest rates without unexpected charges.

- Security and Privacy:

- Description: The platform uses advanced encryption technology to protect users’ personal information.

- Benefit: Ensures that personal data is safe and secure, complying with data privacy laws.

- Flexible Loan Terms:

- Description: Offers flexible loan terms, typically ranging from 7 to 30 days.

- Benefit: Provides borrowers with options that can suit their repayment capabilities.

Cons

- High-Interest Rates for Subsequent Loans:

- Description: While the first loan may have a 0% interest rate, subsequent loans carry an interest rate range 1.5% – 3,98% per day

- Drawback: This can lead to significant interest costs if the loan is not repaid quickly.

- Short Loan Terms:

- Description: Loan terms are relatively short: 7, 14, 21, 31 days period

- Drawback: May not be suitable for borrowers who need a longer time to repay.

- Penalties for Late Payments:

- Description: Late payments incur penalties of 1% per day of the loan amount.

- Drawback: Penalties can quickly add up, increasing the financial burden on borrowers who miss repayment deadlines.

- Limited Loan Amount for First-Time Borrowers:

- Description: First-time borrowers are limited to a maximum loan amount of PHP 10,000.

- Drawback: This may be insufficient for those needing larger sums of money.

- Internet Access Required:

- Description: Since the entire process is online, borrowers need stable internet access.

- Drawback: This can be a limitation for those without reliable internet connectivity.

- Age and Residency Restrictions:

- Description: The service is only available to Filipino residents aged between 21 and 70 years.

- Drawback: Excludes those who fall outside this age range or non-residents.

Eligibility Criteria

To be eligible for a loan from Cash Express Philippines, applicants must meet several criteria:

- Age:

- Applicants must be between 21 and 70 years old.

- Residency:

- Must be a resident of the Philippines.

- Identification:

- A valid government-issued ID is required for verification. Accepted IDs include Passport, National ID, Driver’s License, SSS ID, UMID, Postal ID, or PRC ID

- Bank Account:

- Applicants must have an active personal bank account or e-wallet to receive the loan disbursement

- Contact Information:

- An active telephone number is necessary for communication purposes

These criteria ensure that the applicant is a verified and eligible resident of the Philippines, capable of receiving and repaying the loan within the stipulated terms.

Interest Rates and Fees

Interest Rates

- Special offer for First-Time Borrowers:

- 0% Interest Rate: For the first loan, Cash Express offers a 0% interest rate for the initial 7 days.

- Interest rate for the first 14-day: Only 1% interest per day for our unsecured loan product.

- Repeat Borrowers:

- Interest rate for repeat one: 1.5% – 3,98% per day

Fees

- Late Payment Penalties:

- Penalty Rate: A penalty rate of 1% per day of the loan amount is charged for late payments.

- Additional Penalties: Extra penalties may apply on specific days (e.g., 5th, 10th, 15th, 20th, 25th, and 30th day) which can amount to PHP 125 per instance

- No Hidden Fees:

- Cash Express emphasizes transparency by not charging extra or hidden fees beyond the specified interest rates and penalties for late payments

Example Calculation

For a clearer understanding, here is a simplified example of how interest and penalties might work:

Additional Penalty: PHP 125 on specified penalty days

First-Time Borrower:

- Loan Amount: PHP 10,000

- Interest (First 7 days): 0%

- Interest (After 7 days): PHP 10,000 * 1.99% = PHP 199 per day

- Late Payment Penalty:

- Penalty per Day: PHP 10,000 * 1% = PHP 100

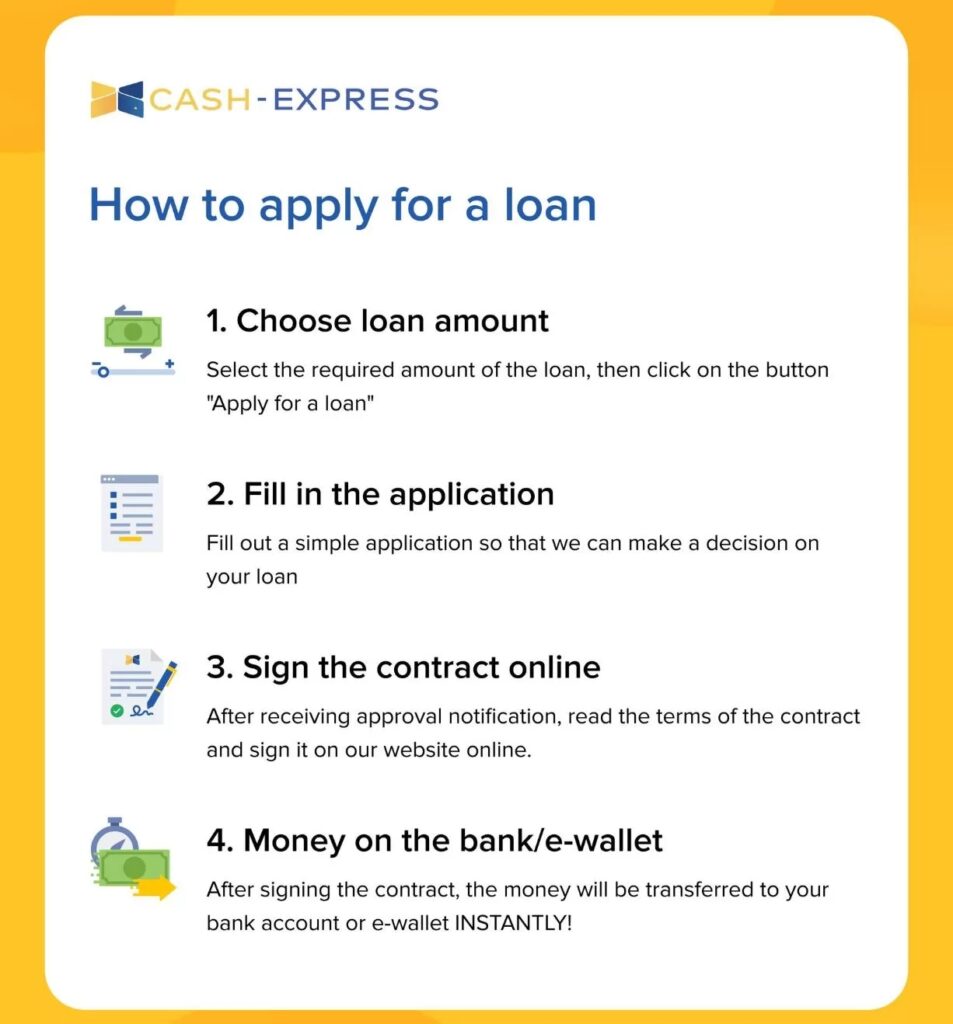

How to apply a loan

Applying for a loan with Cash Express Philippines is a straightforward process that can be completed online. Here are the Step-by-Step Summary

- Register on the website: cash-express.ph

- Fill out the loan application form: Enter loan details and personal information.

- Upload required documents: Valid ID and a selfie with the ID.

- Sign the loan agreement: Review and agree to the terms.

- Loan approval: Wait for verification and approval call.

- Receive the funds: Funds will be transferred to your bank account or e-wallet.

How to repay a loan

Repaying a loan with Cash Express Philippines is a straightforward process. Here are the steps and methods available for repayment

Steps to Repay a Loan

- Log In to Your Account:

- Visit the Cash Express PH website and log in to your account using your registered email and password.

- Navigate to Repayment Section:

- Once logged in, go to the section for “loan”. Choose your repayment amount then click the button “Repay” and open Dragonpay window

- Select Payment Method:

- Choose your preferred payment method from the options provided: 7Eleven, Gcash, Maya, Grabpay…

- Enter Payment Details:

- Enter the required payment details such as the amount to be paid, payment reference number (if applicable), and your bank or e-wallet details.

- Confirm Payment:

- Review the payment details to ensure they are correct, then confirm the payment.

- Receive Confirmation:

- After the payment is processed, you should receive a confirmation of your payment via email or SMS. Ensure to keep this confirmation for your records.

Payment Methods

- Online Banking:

- Many banks in the Philippines offer online banking services that you can use to transfer funds directly to Cash Express Philippines.

- E-Wallets:

- You can use popular e-wallets such as GCash or PayMaya to repay your loan. Simply transfer the required amount from your e-wallet to the Cash Express account.

- Over-the-Counter Payments:

- You can visit authorized payment centers to make your loan repayment in person. Ensure you bring your loan reference number and the exact amount to be paid.

- Auto-Debit Arrangement:

- Some platforms may offer an auto-debit option where the repayment amount is automatically deducted from your bank account on the due date.

Customer Reviews and Testimonials

Positive Reviews: Many customers praise the quick and hassle-free service, along with the helpful customer support.

Negative Reviews: Some clients express concerns over high interest rates and fees.

Overall Rating: Generally favorable, with most users recommending the service for its reliability and convenience.

Safety and Security Measures

Data Protection: Implements robust measures to protect customer information.

Privacy Policies: Clearly outlined policies to ensure the confidentiality of personal data.

Fraud Prevention: Advanced security protocols to prevent fraudulent activities and protect clients.

Comparing Cash Express PH with Other Financial Services

Competitors: Includes traditional banks, credit unions, and other online lending platforms.

Market Position: Cash Express Ph holds a strong position in the market due to its quick service and customer-centric approach.

Unique Selling Points: Speed, convenience, and a range of loan options tailored to different needs.

Tips for Maximizing Benefits from Cash Express Ph

Best Practices: Ensure timely repayments to avoid penalties and maintain a good credit score.

Financial Management: Use loans for essential needs and avoid over-borrowing.

Avoiding Debt: Plan your finances carefully to prevent falling into a debt cycle.

Conclusion

Cash Express PH is a well-regarded and legally compliant online cash lending service in the Philippines. It is ideal for those needing quick access to smaller loan amounts with short repayment periods, offering a high approval rate and fast disbursement times.

Navigating the financial landscape is easier than ever with Cash-Express, a dependable partner for those requiring swift and straightforward financial support. The service is known for its transparent terms, data security, and user-friendly application process, consistently receiving positive feedback from satisfied customers.

If your financial needs match what Cash-Express offers, consider applying for a loan today and enjoy the convenience of online lending in the Philippines.Post navigation